H1 Asset Maintenance

This workpaper is used to record the movement in the fixed asset holdings of the client. Use the H1 workpapers to calculate the value of the asset and adjustments required.

Identify asset purchases made during the year

If an asset is not expected to be converted to cash within the next 12 months, it is classified as a “non-current asset” in the balance sheet.

- Review the following supporting documents for new asset purchases:

- Client questionnaire

- Bank statements

- New hire purchase agreements

- Lawyer’s settlement statements

- Repairs and Maintenance schedule

- Invoices provided by the client

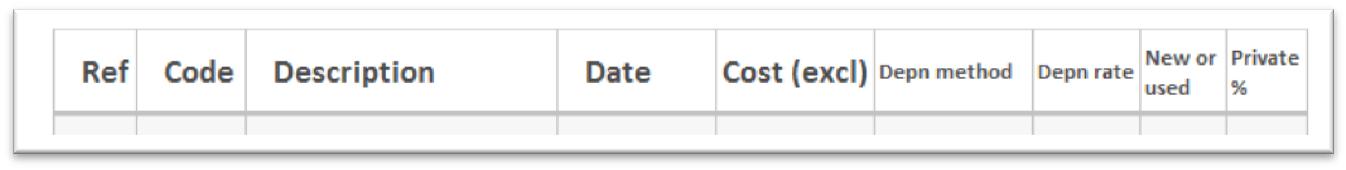

- Enter new assets purchased into the table on H1. For the purchase of a business or property, complete H2 first.

- Ref – Enter the reference number.

- Code – Enter the account code of corresponding account.

- Description – Enter the details of the asset purchase.

- Cost (excl) – Enter the cost of the asset excluding GST.

- Depn method – Identify which depreciation method will be used to depreciate the asset.

- Depn rate – Use the depreciation rate finder to determine applicable depreciation rate.

- New or used – Indicate whether the asset was purchased as new, or used (second hand).

Private % - Indicate what percentage of the time the asset will be used for private purposes.

- Update fixed asset register if it has not yet been updated with the new asset.

- Attach supporting documentation of asset purchase to workpaper or client file.

Identify assets scrapped or sales made during the year

- Review the following supporting documents for assets sold/scrapped:

- Client questionnaire

- Bank statements

- New hire purchase agreements

- Lawyer’s settlement statements

- Repairs and Maintenance schedule

- Invoices provided by the client

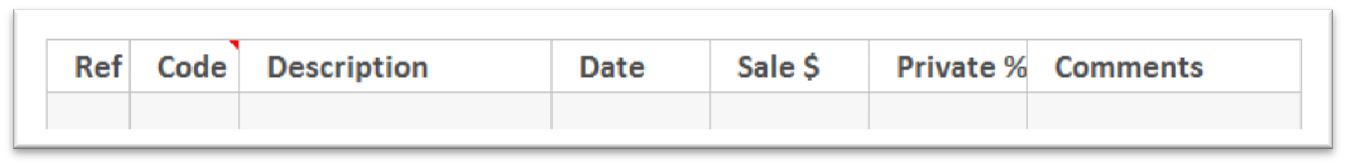

- Enter assets sold/scrapped into the table on H1. For the purchase of a business or property, complete H2 first.

- Ref – Enter the reference number.

- Code – Enter the account code of corresponding account.

- Description – Enter the details of the asset sold/scrapped.

- Date – Enter the date the asset was sold/scrapped.

- Sale $ – Enter the GST exclusive amount the asset was sold for/book value of the item scrapped

- Private % - Indicate what percentage of the time the asset had been used for private purposes.

Comments – Enter comments specific to the asset sold/scrapped in this field.

- Update fixed asset register if it has not yet been updated with the asset sold/scrapped.

- Attach supporting documentation of asset sold/scrapped to workpaper or client file.

Calculate movement of fixed asset account

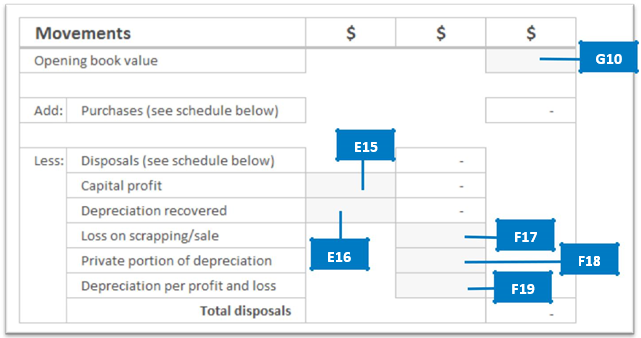

The value of assets purchased, sold or scrapped will automatically update in the movement table.

- Enter the opening book value of all fixed assets into cell G10.

- Where the sale of an asset resulted in a capital profit, calculate the capital profit and enter the amount into cell E15.

- Where the sale of an asset results in required depreciation recovery adjustment, calculate the amount of depreciation recovered and enter into cell E16.

- Where the sale or scrapping of an asset resulted in a loss, calculate amount of the loss and enter into cell F17.

- Where assets are also used for private use, calculate the private portion of the depreciation for the year and enter into cell F18.

- Run the depreciation in the fixed asset register and enter the depreciation amount for the year into cell F19.

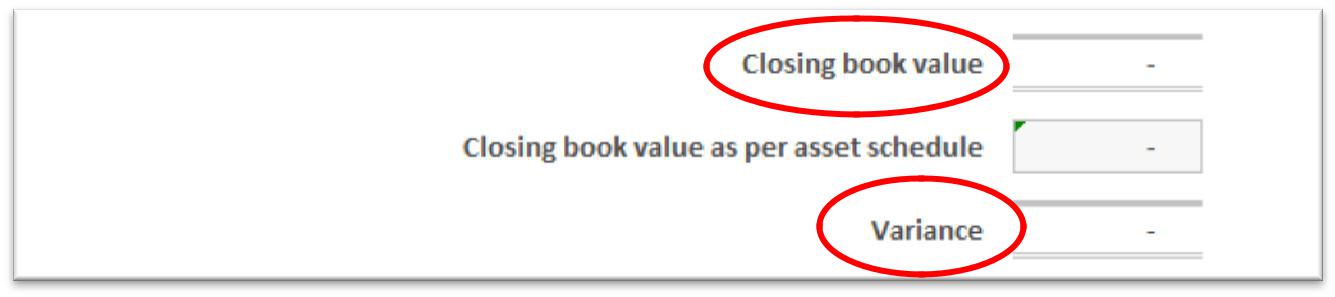

Check variance

Where there is a variance between the closing book value as per the schedule on H1 and the closing general ledger check:

- Has the depreciation schedule report been run/ depreciation generated in accounting software?

- Have the assets been coded correctly? Review balance sheet, fixed asset reconciliation report and profit and loss statement.

- Have the required journal entries been made to account for asset transactions throughout the year?

- Has an adjustment been made for depreciation on assets used privately?

- Have correct depreciation rates been used?

- Are the depreciation calculations correct?