Set up the A1 Tax Calculation codes

The A1 worksheet is used to calculate taxable income for the tax return. When a preparer includes this sheet to the workbook, the codes entered in the Admin Setup sheet will automatically populate the A1 worksheet. It will then pull through the account balances and relevant descriptions based on these codes.

If you are unsure which codes to use, seek assistance from a Client Manager or more senior team member.

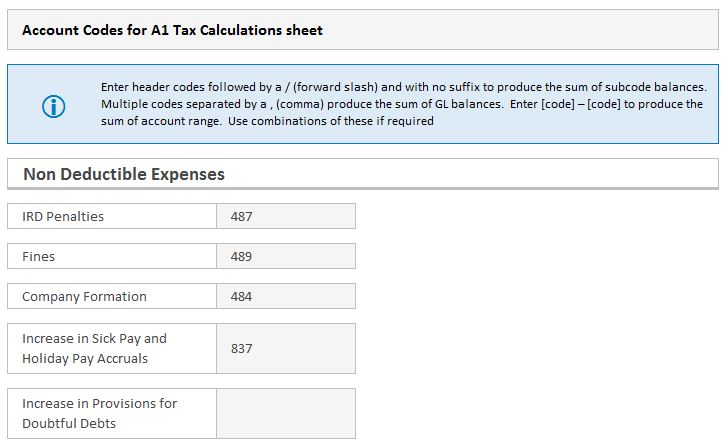

Enter the required codes in the Account Codes for A1 Tax Calculation sheet section on the Admin Setup sheet.

Options for entering account codes:

-

Enter the header codes followed by a / (forward slash) and with no suffix to produce the sum of subcode balances. For example, 200/.

The “/” symbol should be replaced by the Suffix separator symbol as entered on the Admin setup sheet, if this is different.

- Enter multiple codes separated by a , (comma) to produce the sum of general ledger balances.

-

Enter [code] – [code] to produce the sum of general ledger balances for accounts in a range from first code to second (inclusive).

The “-” symbol should be replaced by the Range indicator symbol as entered on the Admin setup sheet, if this is different.

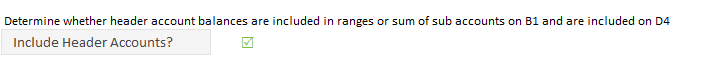

If you want to exclude header balances from range totals and sum of subcodes, clear the Include Header Accounts check box in the General Settings on the Admin Setup sheet.