G1 Accounts Receivable

Accounts receivable are amounts owed by customers or clients to the entity primarily because the entity has provided goods or services on credit. Accounts receivable are also known as “trade debtors”.

Reconcile accounts receivable

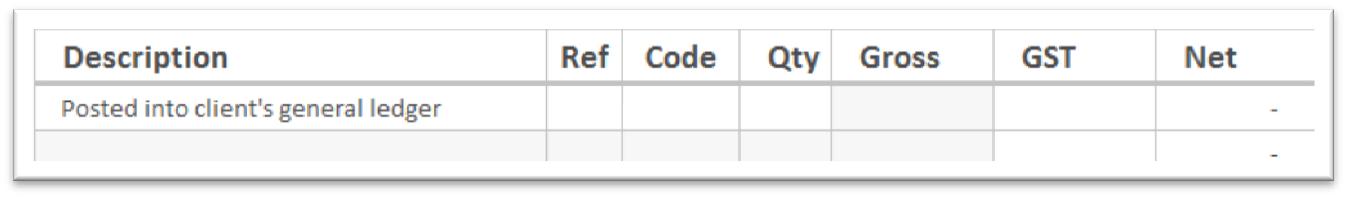

Two tables are available on the workpapers, one for items which include GST and one for items which do not include GST. Ensure you record entries in the appropriate table.

- Reverse out prior year journals.

- Enter current balance of accounts receivable as per client’s general ledger.

- Enter transactions or balance as per client accounts receivable ledger.

- Description – Enter details of the transaction/entry.

- Ref – Enter reference number.

- Code – Enter account code of corresponding account.

- Qty – The number of items the adjustment relates to. E.g. 2 cows.

- Gross – The total amount of the adjustment.

- Check the first 10 days of transactions on the bank statement after balance date to ensure outstanding lodgements are included in debtors if applicable.

- Adjust for any bad debts (enter amounts that reduce accounts receivable as negative).

- Adjust for any provision of doubtful debts (enter amounts that reduce accounts receivable as negative).

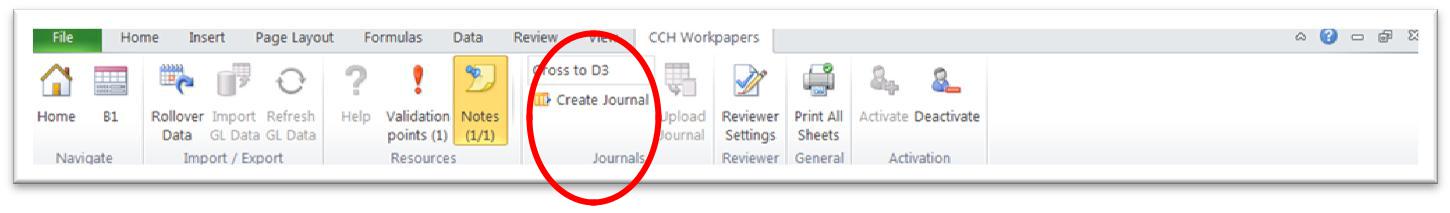

Create journal

Review the Total for journal entry at the bottom of the sheet. Where adjustments have been entered, create a journal to make adjustments to general ledger. See Create a journal automatically.